Perhaps you know of someone who, despite doing well in school, is now a bankrupt because he is poor at managing money. Or you yourself might have had some painful experience dealing with money that you do not wish your child to inherit. Your child’s future well-being has a lot to do with how well he manages the money in his hands. Like virtually everything else, children learn about money matters more from observation, less from instruction. Your child observes what you buy, how you pay for it, and what your choices are in making purchases. These observations take place at an unconscious level; over time, your habits might very well become theirs. The kind thing to do, therefore, is to teach them deliberately about money.

Begin with the end in mind. What is it that you want to achieve when it comes to teaching your child about money? I would suggest to plant the seed of a positive relationship with money. Money is important, it makes a difference to our lives, but at the end of the day, money is a tool, not an end in itself. Children whose parents argue endlessly about money might develop a negative relationship with money, thinking that money is the root of much pain and evil. On the other hand, imagine a couple who is able to discuss rationally about how they spend money while their child listens and absorbs positive vibes about money.

It’s never too early to teach a child about money. For a 3-year-old, you can guide him to save every time he gets pocket money during festive occasions, for instance. By age six or seven, parents are likely to start giving pocket money to buy food and drinks from the school canteen, unless a child brings food from home. You could have a friendly chat with your child so he knows what to expect, knows your expectations, the purpose of getting the pocket money.

Start with the 3S: Save, Share (Sadaqah/Charity), Spend. Young children relate better to things they can see physically. Perhaps you can use 3 jars; each time she gets pocket money, she can distribute it between the 3 jars. This way, instead of getting caught with impulse spending, she learns to plan what to do with the money. Planned purchases means buying things that have been carefully thought through.

Add the voice of reason. Every now and then, tell him why you choose to buy an item and not the other, so he gets a sense of how you use money. This is called the proactive way of parenting; you consciously plan how to instill positive values in your child early. Watch him as you explain things; if he appears confused, simplify your words to help him understand key ideas. Over time, let him decide what to do with the money he saved with a little guidance from you.

Include cashless transactions. How do you teach children money in a cashless economy? Think about the usage of ATM. As funny as it sounds, some children do think that money grows on trees, especially if their parents always use the credit card at the check-out counter. Nobody sits them down to explain how money works. Children are naturally curious; they try to make sense of the world all the time based on what they see you do.

Introduce the concept of earning. At some point in time, talk to your child about where your money comes from; getting paid for doing work that is pay worthy. If you sell an item that you make, for instance, that’s money you earn. But giving an allowance to a child just because they made their bed or washed the dishes is, in my opinion, not appropriate. These are tasks that everyone needs to do. When he is a bit older, introduce the idea of investing in a simple way, for example through stories. You do not have to wait till your child is an adult to teach him about it.

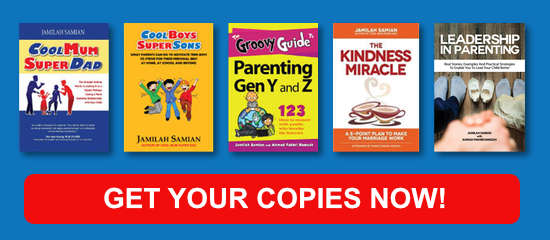

Adapted from “Parenting Generation Y & Z“.

Read article in Malay: Mendidik Anak Tentang Wang.

Image by nattanan23 on Pixabay